Mathai Sibu Kombasseril

Data Scientist | Business Consultant and Strategist

Freelancing @ Around Zero Ltd

"Driven Data Scientist with a strategic mindset and Masters in Computer Science and Data Science. Passionate about using software and data to swiftly address crucial emission challenges in travel, food, and energy."

View my LinkedIn Profile

Selected projects in data science, machine learning and NLP

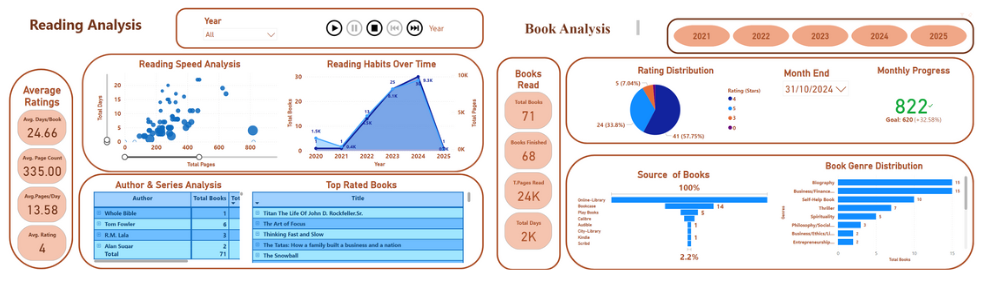

Unveiling the Story of My Reading Journey.

The project, “Unveiling the Story of My Reading Journey,” involves the creation of an interactive Power BI dashboard that visualizes personal reading data. It analyzes various aspects, including genre distribution, reading habits over time, rating distributions, and author analyses. Key visualizations such as pie charts, line graphs, and scatter plots provide insights into reading preferences and productivity. The dashboard also tracks monthly progress towards reading goals and highlights top-rated books. This project exemplifies the effective use of data visualization techniques to derive meaningful insights from personal reading habits.

Access the dashboard here: Power BI Dashboard

Utilizing Advanced NLP Techniques for Real-time Market Sentiment Analysis in the UK’s Emerging Markets.

The aim was to develop a model that leverages Natural Language Processing (NLP) techniques for sentiment analysis in rapidly evolving UK markets, specifically within sectors such as Financial Services, clean energy, and artificial intelligence (AI). The project hypothesizes a significant correlation between market sentiments and market performance and seeks to analyse sentiments expressed in various text sources like social media, financial reports, and news articles. It underscores the evolving applicability of NLP techniques in market sentiment analysis, balancing between the innovative use of machine learning (for data preprocessing, feature extraction, and model training) and a lexicon-based approach using sentiment lexicons like VADER for text scoring.

Unleashing the Power of Sentiment Analysis in UK’s Emerging Markets: A Journey into Real-time Market Insights.

The article explores leveraging NLP for real-time sentiment analysis in the UK’s emerging markets, particularly clean energy and AI. The project involves developing an NLP model to analyze sentiments from financial texts, using mixed-methods research, web scraping, APIs, and machine learning, aiming to provide actionable insights for investors and financial institutions.

How Does the Decision Support System Assist Investors in Making Smarter Financial Decisions?

DSS tools provide investors with strategies for making informed decisions in a disciplined manner. These tools are especially useful due to the increasing number of investment options and vast amounts of market data. Financial tools within DSSs help investors determine how to invest their funds, whether they are individuals or larger investment organizations. The challenge lies in designing DSS tools that consider investors’ preferences and goals while helping them overcome biases and cognitive limitations. As a result, DSS-equipped investors have improved the quality of their investment decisions, leading to increased earnings and decreased risk.

Skills-based Projects

A selection of smaller projects demonstrating specific data science and ML skills.

Working in the cloud: Using data stored in Azure Blob Buckets.